Standard Kepler Research

Global Macro & Digital Asset Strategy

Intelligence for the Discerning Investor

Report Title: Digital Asset Treasuries (DATs): A Bridge to Crypto or a House of Cards?

Publication Date: September 22, 2025

Report Code: SKR-DAT-2025-01

Executive Summary

The emergence of the Digital Asset Treasury (DAT) as a novel corporate structure represents a pivotal, yet precarious, development in capital markets. These publicly-listed entities function as dedicated vehicles for crypto asset accumulation, leveraging a premium derived from traditional market liquidity to provide institutional access. While DATs solve genuine operational and regulatory hurdles, their fundamental viability is intrinsically linked to a market-implied Net Asset Value (mNAV) premium that we assess to be transient. Our analysis concludes that the DAT model is a high-risk, double-edged sword. It offers a regulated on-ramp for institutional capital in the near term but is acutely susceptible to audit complications, market manipulation, and value extraction by insiders. Investors must understand they are making a dual bet: on the underlying crypto assets and, more critically, on the unimpeachable integrity of management. We advise extreme caution and rigorous due diligence.

1. Defining the Digital Asset Treasury (DAT)

A Digital Asset Treasury (DAT) is a publicly-traded corporation whose primary business strategy is the accumulation and management of cryptocurrency assets on its balance sheet. It is crucial to distinguish a DAT from a traditional operating company (e.g., MicroStrategy) that holds Bitcoin as a treasury reserve asset. A DAT’s raison d’être is to function as a pure-play capital formation vehicle for crypto exposure.

In essence, DATs are the evolution of the Special Purpose Acquisition Company (SPAC) model, adapted for the digital age. Their setup often involves:

- Corporate Structure: Utilizing a publicly-listed shell company or pivoting an existing, struggling public entity.

- Strategy Announcement: Formally declaring the new digital asset treasury strategy via an SEC FORM 8-K.

- Capital Raise: Primarily funded through Private Investment in Public Equity (PIPE) transactions, where institutions provide capital (often in crypto) in exchange for discounted, locked-up equity shares.

| Asset Type | Example (Ticker) | Funding Amt (USD) | Investors/Partners |

| Bitcoin (BTC) | – MSTR – DJT – GME – TSLA – NAKA – SQNS | $83,691,500,000 | Custody: Gemini, Swan Bitcoin, Anchorage Digital, crypto.com Placement Agents: Clear Street, Aegis Capital Investor: Empery Asset Management, Pantera Capital, FalconX, Arrington Capital, UTXO Management, ATW Partners, Tether, SoftBank, Bitfinex |

| Ethereum (ETH) | – SBET – ETHM – DOCT | $3,124,500,000 | Investors: Kraken, blockchain.com, Pantera Capital, Electric Capital, 1Roundtable/10T, Archetype; Anchor: Andrew Keys, Consensys, Pantera Capital, Galaxy Digital, ParaFi Capital, Electric Capital, Arrington Capital, Ondo Finance |

| Solana (SOL) | – HODL – DFDV – UPXI – ARTL | $430,725,000 | Custody/Staking: CUBE Credit: Antanas Guoga Investors: Big Brain Holdings, Bartosz Lipiński |

| BNB | – NA | $500,000,000 | Custody/Staking: CUBE Credit: Antanas Guoga Investors: Big Brain Holdings, Bartosz Lipiński |

| Solana (SOL) | – SRM | $210,000,000 | NA |

2. The Core Mechanics and the Critical mNAV Premium

The DAT model is predicated on four pillars:

- Public Listing: Provides access to deep, traditional equity capital markets (e.g., NASDAQ).

- Treasury-Eligible Assets: A focus on large-cap, liquid cryptocurrencies (BTC, ETH) to facilitate auditing and liquidation.

- PIPE Financing: The dominant mechanism for capital acquisition, creating aligned (but potentially conflicted) institutional investors.

- The mNAV Premium: This is the lifeblood of the DAT. The market-implied Net Asset Value (mNAV) ratio measures the company’s market capitalization against the net value of its crypto holdings. An mNAV > 1.0 indicates a premium, signifying investors are paying more for the equity than the underlying assets are worth.

Source of the Premium: The premium is not derived from the DAT adding fundamental value to the crypto. It exists because the DAT’s stock provides access to traditional market liquidity. Investors pay a “convenience fee” to avoid the technical and regulatory hurdles of direct crypto ownership (custody, crypto exchanges, tax complexity).

3. Investment Thesis: The Legitimate Benefits

Despite the risks, DATs address a clear market need:

- Institutional Access: Offers a familiar, regulated equity security for institutions with mandates prohibiting direct crypto ownership.

- Operational Efficiency: Abstracts away complex custody, security, and accounting challenges from the investor.

- Capital Efficiency: The mNAV premium creates a self-reinforcing cycle, allowing DATs to raise more capital per dollar of crypto held, which can be deployed for staking yield or ecosystem investment.

4. Risk Analysis: A Vector for Malfeasance

The unique structure of DATs creates significant and novel risks, particularly as actors rush to exploit the fleeting mNAV premium.

- Audit and Valuation Risk: Verifying on-chain assets remains a nascent field for traditional auditors. The inability to reliably confirm wallet control and asset valuation presents a critical vulnerability, opening the door to undetected errors or fraud.

- Market Manipulation Risk: DATs can engineer a powerful feedback loop. An announcement of an intention to buy a specific coin can pump its price, simultaneously driving the DAT’s stock price via the mNAV narrative. Insiders can profit by dumping both positions after lock-up periods expire.

- Value Extraction Risk (Most Severe): The primary method of abuse involves insiders or PIPE investors contributing overvalued, illiquid, or worthless tokens from projects they control to the DAT in exchange for valuable public equity. This effectively robs shareholders, exchanging liquid public stock for deflated or worthless assets.

5. Outlook & Investment Implications

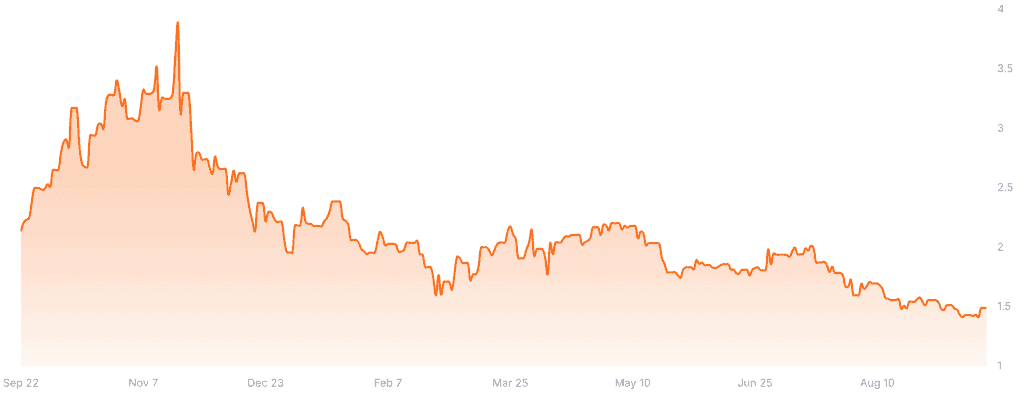

The mNAV premium has a limited shelf life. It is a transient feature of the current, early stage of institutional adoption. As crypto infrastructure matures—through bank-offered custody, integrated Bloomberg terminal services, and clearer regulation—the convenience fee offered by DATs will compress. We project the premium will eventually shrink to zero or even become a discount (mNAV < 1.0), reflecting the corporate overhead of the DAT structure.

Standard Kepler Research Conclusion: The DAT model is a high-risk, tactical instrument, not a strategic long-term hold. Its viability is on a definitive timeline. Legitimate DATs are in a race to build sustainable value before the premium vanishes, while fraudulent ones are incentivized to extract value quickly. The recent extreme volatility in DAT stocks is a direct reflection of these opposing pressures.

Recommendation: High Risk / Speculative Hold. For investors who must gain exposure through this channel, we advise an intense focus on management integrity, transparency, and audit quality over the underlying asset portfolio. Treat the mNAV premium as ephemeral capital. The sector requires stringent auditing standards, clear regulation, and educated investors who understand they are betting on both crypto and, more importantly, the trustworthiness of a management team.

Disclaimer: This report is for informational purposes only and does not constitute investment advice, a recommendation, or an offer to buy or sell any securities. The analysis presented is based on current market conditions, which are subject to change. Standard Kepler Research is not responsible for any investment decisions made based on this information. Investors should conduct their own due diligence and consult with a qualified financial advisor before making any investment decisions.